Lots of bad things happen at night when no one is around. These things hurt people and cost families a lot of money. AD&D insurance can help if an accident hurts or kills someone. What if you die or get hurt badly in an accident and can’t see or lose limbs? Your money is safe. Where can I get AD&D insurance? Is it the best choice for you?

AD&D insurance has both good and bad points. To protect yourself more than your regular life insurance does, or if you’re a single parent, you should learn about them. Make sure you and your family don’t lose money when bad things happen by getting AD&D insurance. You can now rest.

AD&D insurance doesn’t do its job. Life insurance differs from this because the rates are usually low, and the money is sometimes given immediately. This protection is essential in case of an accident, whether it’s at work or somewhere else. But it can’t do everything. Also, you need to know how much it costs all together.

Find out how AD&D insurance can help you plan for the future and keep your family safe from the dangerous things that can happen. Find out what’s good and bad about this strategy and why many people should go with it by reading about it.

Table of Contents

What Does AD&D Insurance Cover?

That way, your money will be safe if you die or get hurt badly in an accident. AD&D plans and life insurance are not the same. AD&D plans will only cover this type of car crash. People who own or deserve things are given money to pay for them.

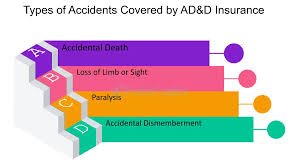

Which of these does most AD&D insurance cover?

Their accident insurance business will pay a lump sum if someone dies in an accident that wasn’t their fault.

Damage to body parts: AD&D insurance will pay out if you lose a body part, like your hands or feet, or if you get hurt so badly in an accident that you can’t see, hear, or speak.

Different plans partially pay for benefits, which offer various amounts of money to people who lose a limb or some of their sight in an accident.

Many people get hurt at work, in car accidents, when they fall, and when they drown.

However, you should know what AD&D insurance doesn’t cover. Most of the time, insurance companies don’t pay for people who die because they are sick, hurt, in an accident, playing risky sports, or doing other dangerous things.

Who Should Consider AD&D Insurance?

You can keep your money safe in case something terrible happens, and you die or get hurt. Make sure AD&D is safe. But who will benefit the most from this news?

People who are young and healthy: Anyone can have an accident. Young, healthy people who don’t want to protect their money shouldn’t have that much money. AD&D insurance could be a cheap way for them to do that.

People who drive, build, or make things are in great danger at work. You should get AD & D insurance to ensure safety if you work in one of these places.

Hey, sports fans! AD&D insurance can protect you if someone gets hurt or dies while you walk, ride a bike, or play sports outside.

Getting AD&D insurance will not cost much. It will keep your family safe when needed, and it can also make them feel better sometimes.

There will be enough money for everyone in your family if you are the only one who gets paid.

Key Advantages of AD&D Insurance

AD & D insurance can help people protect their money in many ways when bad things happen. This plan can be used by itself or with other types of life insurance. Taking care of some things can help you relax when bad things happen.

Ad&D insurance is usually less expensive than regular life insurance, making it a good choice for poor people.

You can get money right away. People who have AD&D plans will get a lump sum if an accident kills or badly hurts someone they cover. It helps them get through hard times, so it’s essential.

A D&D character can lose a leg, sight, hearing, or words, but they don’t have to die. We’re not talking about health insurance here.

You can get AD&D insurance on its own or with health insurance. This can be changed to help your idea work better.

Many AD&D insurance plans don’t require a doctor’s visit. They’re great for sick people who might not be able to get regular life insurance.

Limitations of AD&D Insurance Policies

Before you buy AD&D insurance, you should know what it doesn’t cover. Once you know these boundaries, you can decide if this type of safety meets your needs.

1. However, AD&D insurance will only pay for inevitable accidents where people get hurt or die. This type of life insurance is less safe because it doesn’t cover deaths from sickness, natural causes, or getting older.

2. Activities with many risks: Most AD&D plans don’t cover things that happen because of illegal, risky, or dangerous sports. Your claim might be turned down if you always do these things.

3. Third, it only covers things that happen at work. Most of the things that workers’ compensation covers are covered by something other than AD & D insurance. It’s not likely that you’ll get hurt at work.

4. AD&D insurance will sometimes pay for accidents. You might only get part of the prize if you lose one leg.

5. Short-term or extra coverage: AD&D insurance is best used as additional safety. This is not the same as insurance against death or damage.

Consider whether AD & D insurance is a good way to keep your money safe or if you need more coverage.

How AD&D Insurance Supports Financial Security

Injury and Death (AD&D) insurance will protect your money if you get hurt or killed in an accident. Anyone and their family can pay their bills with this plan, even when things get tough.

- Ad&D insurance pays a big lump sum to the family of someone who dies or is badly injured in an accident.

- What does this mean? This money can help people who lost their jobs live the way they did before.

- Getting paid to do good things: People who play AD&D can lose limbs, sight, or hearing. Now that things are better, you can use this money to pay for medical care and home repairs.

- Life insurance costs more than AD&D insurance, so it’s a costly way to ensure you have enough money. It also makes you feel good.

If something happens that hurts or kills someone, AD&D insurance will pay to protect the person and their family. Having a bigger plan is essential to keep your money safe.

Comparing AD&D Insurance with Traditional Life Insurance

If you know the difference, the money for your family is safe.

Your AD&D insurance will pay out. It’s great for people who want to save money and stay safe. It doesn’t cover losses that happen on their own, like when someone gets old or sick. How badly the body part was hurt also affects accident pay.

Real-life insurance doesn’t work that way. It will pay out no matter what killed you if it doesn’t say otherwise. Getting sick and nature events are on this list. The money will be safe for your family in the long run because it will cover rent, bills, and other daily costs. Life insurance costs more and often requires medical tests because it covers more things.

How much money you want to make will determine what you do. The best way to stay safe is to get basic life insurance. AD&D insurance, on the other hand, is a good extra if you want a cheap way to cover injuries.

Reading about the pros and cons of each plan can help you choose the best way to protect your money.

Customizing Your AD&D Insurance Plan

You could also change your mind. You can alter the risks you’re willing to take, how you spend your cash, and the types of insurance you own.

- Make sure you know what kind of help you need first. Before you do something, think about what could go wrong. Because they are too busy or have dangerous jobs, some people may need extra insurance if they get hurt at work or in their free time.

- Many “riders” can improve your AD&D plan for an extra fee. 2. Pick the Correct “Riders.” You can choose to add “trip accident coverage,” “family riders,” or “double indemnity” to your insurance. These talk about things that might happen that would raise its value a lot.

- Third, pick the correct number of perks. Think about what kind of family accident insurance you need. Here, write down your long-term money goals, your usual bills, and any loans you have.

- Fourth, get more than one plan at the same time. It is best to have AD&D insurance, health insurance, or money to cover lost pay. If you buy everything from the same company, the prices might decrease.

- reread it and make some changes. Things change quickly, so plan often. You can change the policy rules, the bonuses, or the safety if you need to.

You can change your AD&D plan to suit your needs.

Real-Life Scenarios Where AD&D Insurance Helps

If someone gets hurt or dies in an accident, this will help you keep your money safe. When you think about these options, you can see the importance of safety.

A lot of the time, car accidents kill people. If someone they cover dies in an accident, their AD&D insurance pays them a lump sum. This money can be used for funerals, hospital bills, and lost wages.

If someone gets hurt or killed on the job, this type of insurance will pay out. It will be fun for people who build or make things. This money can help you get better and heal, and it can also help you make up for the money you lost.

It could hurt. AD&D insurance helps pay for your medical bills and time off work while you heal.

If these happen, you and your family will not have to pay for health care, which can help when times are tough.

How Much Does AD&D Insurance Typically Cost?

Accident insurance is great because it’s not expensive, even if it causes death or harm to body parts. Most of the time, AD&D plans cost less than regular life insurance payments, so many people who want extra financial security can get them. But how much does AD&D insurance cost?

- The amount of AD&D insurance you get is a big part of its costs. It costs around $5 to $20 a month to cover up to $500,000 in AD&D. Most of the time, paying more for care means more money.

- Rates Can Change Depending on Job and Age: Your rates may also change if you get a new job or age. If someone is younger or has a less dangerous job, they might pay less. But people who work in hazardous jobs, like transportation or buildings, might have to pay more because accidents often happen there.

- Extra Riders: Adding extra riders to your AD&D insurance, like money for things that happen while you’re moving or safety for your family, could increase the cost in the long run.

- Fourth, you don’t need to go through any medical tests. AD&D insurance is often less expensive than other types because it’s simple to get.

On top of that, AD&D insurance is a good choice for cheap security in case something goes wrong.

Is AD&D Insurance Worth It for Your Family?

It costs little to ensure your family has money in case someone gets hurt. But is it worth it for your family? Check out these tips to see if AD&D insurance is a good deal.

Having AD&D insurance is like having a safety net in case something goes wrong. If you die or are badly hurt in an accident and lose a limb or your sight, your family will get a one-time payment. This money can help your family pay for the funeral, your hospital bills, and the money you lost from not working. Now more than ever, they need it.

If you want to save money, don’t get health insurance. AD&D insurance is a better choice. Getting more life insurance doesn’t have to cost a lot of money.

Third, getting extra coverage. AD&D insurance isn’t the same as regular life insurance, but it can be helpful to have additional coverage. AD&D will pay for your life insurance if something bad happens. You can care for your family more often this way.

4. Great for people who are very likely to get sick: Some dangerous things you or a family member do, like play sports or drive for long hours, can make you and your family feel safer.

AD&D is a good choice if you have a family and want cheap accident insurance. They can save money this way in case something goes wrong.

Conclusion

Accidental Death and Dismemberment (AD&D) insurance can help you keep your money safe in case of an accident. It’s also very cheap. But AD&D insurance does cover things that kill or badly hurt someone, like losing a limb, your sight, or your hearing.

AD&D insurance is cheap and can help you immediately with money troubles. This guide has discussed many good things about it. Family AD&D plans help them keep their money together in case of an accident, like a car crash, an injury at work, or an accident at play. They do this by providing some benefits. You can change the amount of coverage or add extra riders to your AD&D insurance plan so it will also fit your needs.

However, this AD&D protection only covers some things. It does not cover accidents, illnesses, or habits that make people more likely to get hurt. Even though AD&D insurance doesn’t cover these things, it’s still a cheap way to keep your money safe.

There are significant differences between the two kinds of life insurance. Life insurance pays out if you die from any cause, but AD&D only pays out if you die in an accident. You can get both simultaneously to be fully protected against everyday risks and accidents that happen out of the blue.

Getting good value on AD&D insurance is possible if you want to protect your family from the rough parts of life. Ensure your family has enough money for the future by getting AD&D insurance. You can add or get more coverage if you live a high-risk life.

Share this content: